Members

Welcome to OPTrust Select, a defined benefit pension plan. OPTrust Select was designed to work together with your personal savings and your Canada Pension Plan and Old Age Security payments to give you a secure source of retirement income. The low contribution rate allows you the flexibility to supplement your retirement income with a personal savings strategy that supports your retirement goals.

Your Guide to OPTrust Select

This booklet provides a summary of the features of your OPTrust Select pension. Please read it carefully as it contains important information that will be helpful at all stages of your career. Our Member Experience team is available to assist you if you have questions.

OPTrust Select Plan Overview

This webinar covers key topics including an introduction to OPTrust Select, pension benefits, options for buying back past service, and more.

Interested in joining OPTrust Select?

Helpful Topics

To join, your employer must participate in OPTrust Select and you must be eligible under your employer’s participation agreement. If you are eligible, your membership will be mandatory or optional depending on your age and employment status. You can find more information about eligibility on the first page of the Membership Enrolment form.

In general membership in OPTrust Select is:

Mandatory for eligible employees if you are:

- less than age 65, and

- working on a full-time, continuous basis.

Optional for eligible employees if you are:

- less than age 65 and working on a less than full-time continuous basis (e.g., part-time), or

- between the ages of 65 and 71 when you enrol.

Prohibited if you are:

- participating in the primary schedule of benefits under the Plan

- receiving a pension from OPTrust

- over age 71, or

- not part of an eligible group under your employer’s participation agreement.

Not sure about your specific situation? Contact your human resources representative.

Once you join OPTrust Select, you and your employer both contribute toward your pension. Your contributions will be deducted from each pay at a rate of three per cent of your pensionable pay. Your employer will match the contributions you make.

Your pensionable pay equals the regular salary or hourly wages you earn during each pay period. Pensionable pay does not include overtime pay, bonuses or other lump sum payments in lieu of benefits, or any payment determined by OPTrust not to be pensionable.

Exactly when you become a member and start contributing depends on whether your membership in the Plan is mandatory or optional:

- If your membership is mandatory, your membership will begin on the latest of your hire date, the date your employer becomes an OPTrust Select employer or the date you return to work from a leave of absence.

- If your membership is optional, you may choose to join at any time before you reach age 71 while you are employed by a participating employer.

As a member of OPTrust Select, you will be receiving a statement from us each spring that provides details about the benefit you have built in the Plan.

As time passes, your statement will give you a "snapshot" of how your pension is growing, year by year. Want to learn more?

Everyone’s benefit will be unique to their situation as it’s calculated based on the number of years they contribute to the Plan and their annual salary in each of those years. OPTrust Select pensions are based on a modest contribution rate that is designed to be affordable based on research about the nonprofit sector. Therefore, the corresponding benefit will also be modest and is designed to work alongside other sources of retirement savings to help provide members with a retirement income that will allow them to maintain their standard of living in retirement.

Some retirement experts say you should plan on generating 55% - 75% of your annual pre-retirement income for each year of retirement. It’s important to note that while OPTrust Select can play a role, it’s designed to be a supplement to government plans and your personal savings.

Your lifetime OPTrust Select pension is based on a formula which takes into account a set percentage (0.6%) of your annualized pensionable pay and the pension service you earn in each year of employment. For each year of OPTrust Select membership, the pension amount you earn is calculated as follows:

As long as your employer participates in OPTrust Select, your membership in the Plan will continue until you reach the earliest of the following:

- termination of your employment

- retirement

- November 30 of the year you turn age 71, which is the Income Tax Act limit for accruing a pension, or

- death

Age 65:

- You are eligible for an unreduced pension when you reach age 65. To start your pension, you need to terminate employment with your OPTrust Select employer and notify OPTrust at least three months in advance.

Age 55-65:

- You can terminate employment and begin receiving your pension anytime between ages 55 and 65. If you choose to start your pension before age 65, your pension will be permanently reduced because you will receive it longer.

After age 65:

- You can also continue working past age 65. If you do, you will continue to contribute to OPTrust Select and increase your pension. Under the Income Tax Act, you must start receiving your pension no later than the end of the year in which you reach age 71.

Factsheets and Forms for Members

Factsheets

Forms

To complete a fillable form, download a copy, save it on your computer, and open it with Adobe Reader (the latest version is recommended). If you do not have it installed on your computer, you may download the latest version free of charge from http://get.adobe.com/reader/otherversions

Have you left your position with an OPTrust Select employer?

If you have left your position with an OPTrust Select employer and have chosen to collect your pension at a later date, please be sure to keep your email address and contact information up to date with OPTrust so you continue to receive all the important details you need to know about your pension. As well, please let us know at least three months prior to when you want to start collecting your pension. Contact us to stay in touch.

Planning for Retirement

Some retirement experts say you should plan on generating 55% - 75% of your annual pre-retirement income for each year of retirement. Your OPTrust Select pension, along with other sources of income such as government benefits and personal savings, will help you maintain your current lifestyle in retirement but there is a lot to think about and plan for!

- Review your Annual Pension Statement each year.

- Have a look at the Government of Canada’s Retirement Income Calculator. It will help you see how the different sources of your retirement income work together.

- Start thinking about a retirement date.

- o You can retire with an unreduced pension at age 65 – or as early as age 55, with a reduction. Contact OPTrust if you need an estimate of your reduced pension.

- Consider your Canada Pension Plan and Old Age Security benefits. Sign up for a My Service Canada account that lets you apply, view estimates and update your information for CPP and OAS.

- If you’re in a common law relationship, look at our How to Prove Your Spousal Relationship factsheet. The document outlines what proof we need to confirm that your spousal relationship meets OPTrust Select’s requirements.

- Notify your employer of your intent to retire

- Collect the documents that you will need to process your pension information:

- Proof of marriage or common law status (See How to Prove Your Spousal Relationship)

- Proof of birth for your spouse

- If you have a spouse, consider if you wish to provide your spouse with a survivor pension of 60%, 65%, 70% or 75% of your pension, or if you and your spouse would prefer to waive the survivor benefit.

- Now is the time to decide what to do with your government pension programs. Apply in advance for the Canada Pension Plan (CPP) and Old Age Security (OAS) benefits:

- Decide when to collect CPP, you can start as early as age 60 or defer it as late as age 70. You must apply with Service Canada to collect CPP.

- Decide when to collect OAS, you can start as early as age 65 or defer it as late as age 70. Contact Service Canada for more details.

- Update your TD1 Form if your tax bracket changes.

- We will send you a retirement package outlining your pension benefit and survivor pension options and explaining what documents we need.

- Your pension will start in the month following your retirement date. It is deposited directly to your bank account, typically on the 26th of the month, and is payable for your lifetime.

Enjoy your well-deserved retirement!

Contact us three months before you would like to start collecting your pension. Your message should include your OPTrust Select ID, your spouse’s name and date of birth, and the month you wish your pension to begin. Our team will respond to you with your pension options.

What you need to know

OPTrust Select’s features:

About the Plan

OPTrust Select is a schedule of benefits under the OPSEU Pension Plan, one of the top 10 public sector pension funds in Canada.

The fund has over $26 billion in assets. This is large enough to access investment opportunities that single employer plans like group RRSPs typically cannot. These investment opportunities allow OPTrust to diversify, and lower the risk associated with day-to-day market fluctuations.

In-house investment experts take the guesswork out of managing retirement savings.

As a long-term investor focused on providing pensions for our members now and into the future, we integrate environmental, social and governance issues, such as climate change and gender diversity, into our investment decision-making.

The Plan is fully funded, which means that we can deliver on the retirement promise made to all members: secure, predictable retirement income – for life.

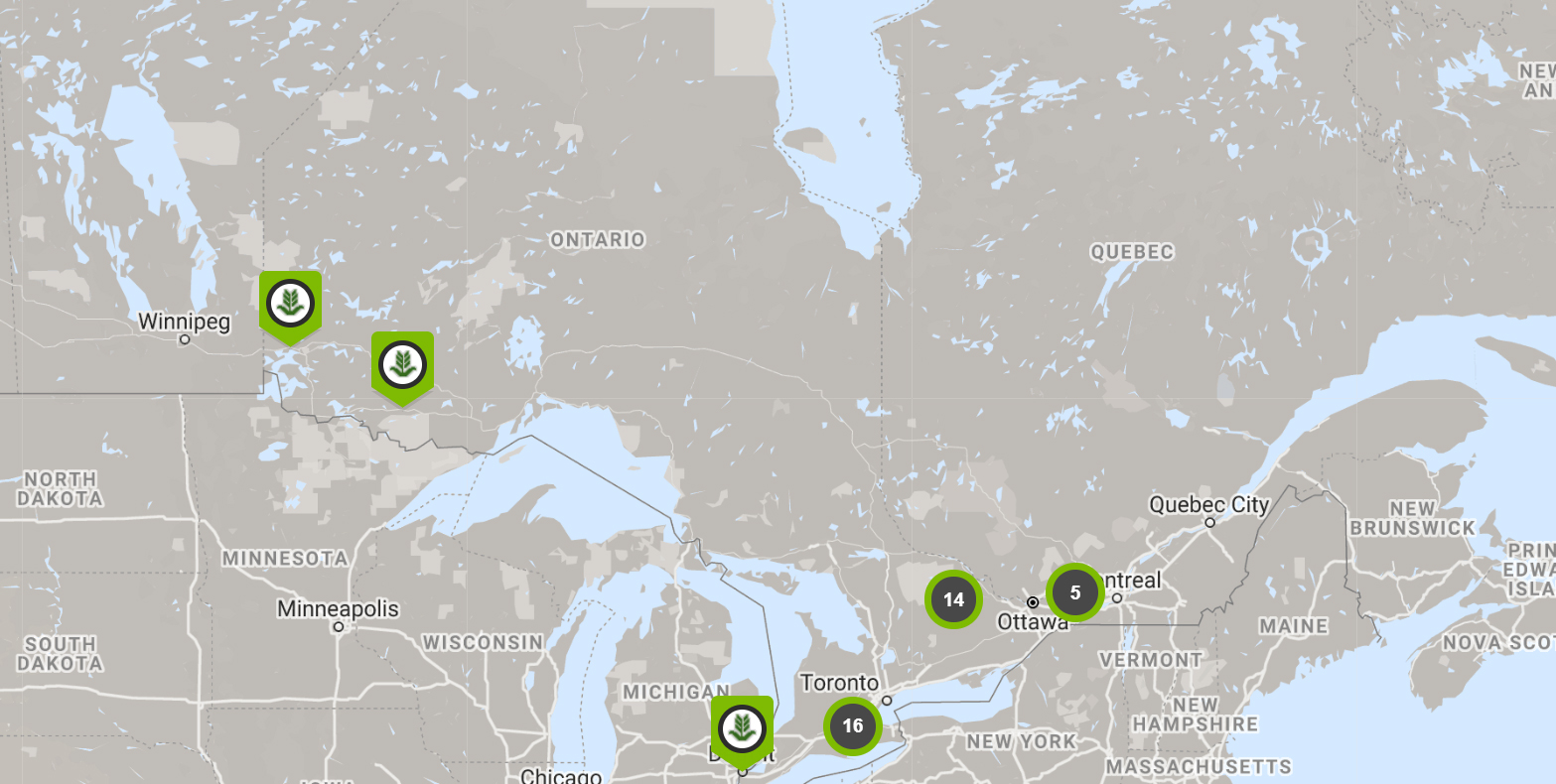

OPTrust Select Employers

OPTrust Select is designed specifically for organizations in the nonprofit, charitable and broader public sectors in Ontario and brings the advantages of OPTrust’s large scale and investment expertise to organizations that did not previously offer a defined benefit pension. The people who have joined OPTrust Select provide a range of critically important services including healthcare, community support and environmental advocacy. View the interactive map

- ARCH Disability Law Centre

- Alternative Learning Styles and Outlooks Ottawa

- Assaulted Women's Helpline

- Barry's Bay and Area Senior Citizens Home Services

- Brockville and Area Community Living Association

- Canadian AIDS Treatment Information Exchange

- Canadian Environmental Law Association

- Canadian Mothercraft Society

- Canadian Veterinary Medical Association

- Cedarhurst Dementia Care Home

- Central Toronto Youth Services

- Centre éducatif Brin de Soleil

- Clean Air Partnership

- Clinique juridique de Prescott-Russell

- Coaches Association of Ontario

- Community Food Centres Canada

- Community Legal Education Ontario

- Community Living North Bay

- Compass Early Learning and Care

- Conseil Économique and Social d’Ottawa Carleton

- Contact Brant

- Cota Health

- Crows Theatre

- Eastern Ottawa Resource Centre

- Family Councils Ontario

- Hospice Toronto

- Job Skills Employment Services and Programs

- Kawartha Participation Projects

- Kitchener Waterloo Multicultural Centre

- Learning Disabilities Association of Windsor-Essex County

- Learning Enrichment Foundation

- MSC Canada

- Mind Forward Brain Injury Services

- Minwaashin Lodge-Indigenous Women’s Support Centre

- Muslim Association of Canada

- Newcomer Centre of Peel

- Niagara Community Legal Clinic

- Niagara Peninsula Aboriginal Area Management Board

- North York Community House

- North York Harvest Food Bank

- Nunavut Sivuniksavut

- Ontario Nonprofit Network

- Park People

- Parkdale Activity Recreation Centre

- People For Education

- Peterborough Child and Family Centres

- Peterborough Green-UP Association

- Peterborough Reintegration Services (One City Peterborough)

- PHARA Community Services

- Second Harvest Canada

- Sedna Women's Shelter and Support Services Inc. (Denise House)

- Senior Peoples' Resources in North Toronto Incorporated (Sprint Senior Care)

- Sistering, A Woman's Place

- St. Clare's Multifaith Housing Association

- Times Change Women's Employment Service

- Tri-County Community Support Services

- Water First Training and Education Inc.

- Willowdale Community Legal Services

- Woman Abuse Council of Toronto

- Women’s Centre of York Region

- Women's Shelter Saakaate