Employers

As an OPTrust Select employer you will be assigned a Pension Partner at OPTrust who will be your primary contact. Alternate contacts will also be provided should your Pension Partner be unavailable. It is important for members and employers to access forms and information from the OPTrust Select website.

Plan changes to accommodate temporary part-time work arrangements

Starting on February 1, 2022, OPTrust Select members who participate in a 'temporary part-time work arrangement' are permitted to make pension contributions based on their regular hours, and OPTrust Select employers are required to match their contributions. Read the full employer update.

Data Transmission Site

Upload data directly to OPTrust. The site makes it easy to transmit contribution and other employee data quickly and securely.

Log inEmployer Manual

This manual provides information on the administrative requirements for an OPTrust Select employer.

Forms for Employers

To complete a fillable form, download a copy, save it on your computer, and open it with Adobe Reader (the latest version is recommended). If you do not have it installed on your computer, you may download the latest version free of charge from http://get.adobe.com/reader/otherversions

Helpful Topics

You will be assigned a “Pension Partner” at OPTrust. This person will be your primary contact, and will respond to your questions within two business days. Your Pension Partner will schedule periodic meetings to keep you up to date, and may at times have questions about your data.

Member Regular Contributions

Members are required to contribute 3% of their gross pensionable pay. You are required to deduct member

contributions from each pay and remit them to OPTrust within specified timelines

Employer Regular Contributions

You are required to match the 3% of members’ pensionable pay.

When a member is absent from work on an approved leave of absence, member and employer contributions may be mandatory or optional, depending on the type and length of the leave.

Member Contributions

For administration and reconciliation purposes, member contributions are required to be remitted to

OPTrust within five business days from the date of deduction.

Employer Contributions

For administration and reconciliation purposes, all employer contributions are required to be remitted to

OPTrust with the related member contributions (i.e. within five business days from the date the member

contributions were deducted from pay).

Employer Questions and Answers

Employers may be eligible to join OPTrust Select if they are:

- a charity in Ontario registered under the federal Income Tax Act

- a not-for-profit organization in Ontario incorporated under the Corporations Act (Ontario)

- a broader public sector organization in Ontario that receives a minimum amount of funding from the provincial government, or

- an eligible organization whose employees are represented by OPSEU and are not already eligible to participate in the OPSEU Pension Plan or another defined benefit pension plan.

An organization that is interested in participating in OPTrust Select must submit an application form to OPTrust, with a copy of the organization’s audited financial statements for the past three years and five years of depersonalized employee data. We will also ask the organization to sign a confidentiality agreement before any exchange of information. To request an application form, please email info@optrustselect.com or call 416 681-3609.

Participation in OPTrust Select is not automatic and must be approved by OPTrust. When reviewing an employer’s application, OPTrust considers a number of factors, including the organization’s financial viability, employee data and its administrative capabilities.

Employees will contribute 3% of their regular salary and the organization will match those contributions. Employers must also pay an additional 0.2% for the first two years they participate in OPTrust Select (3.2% in total).

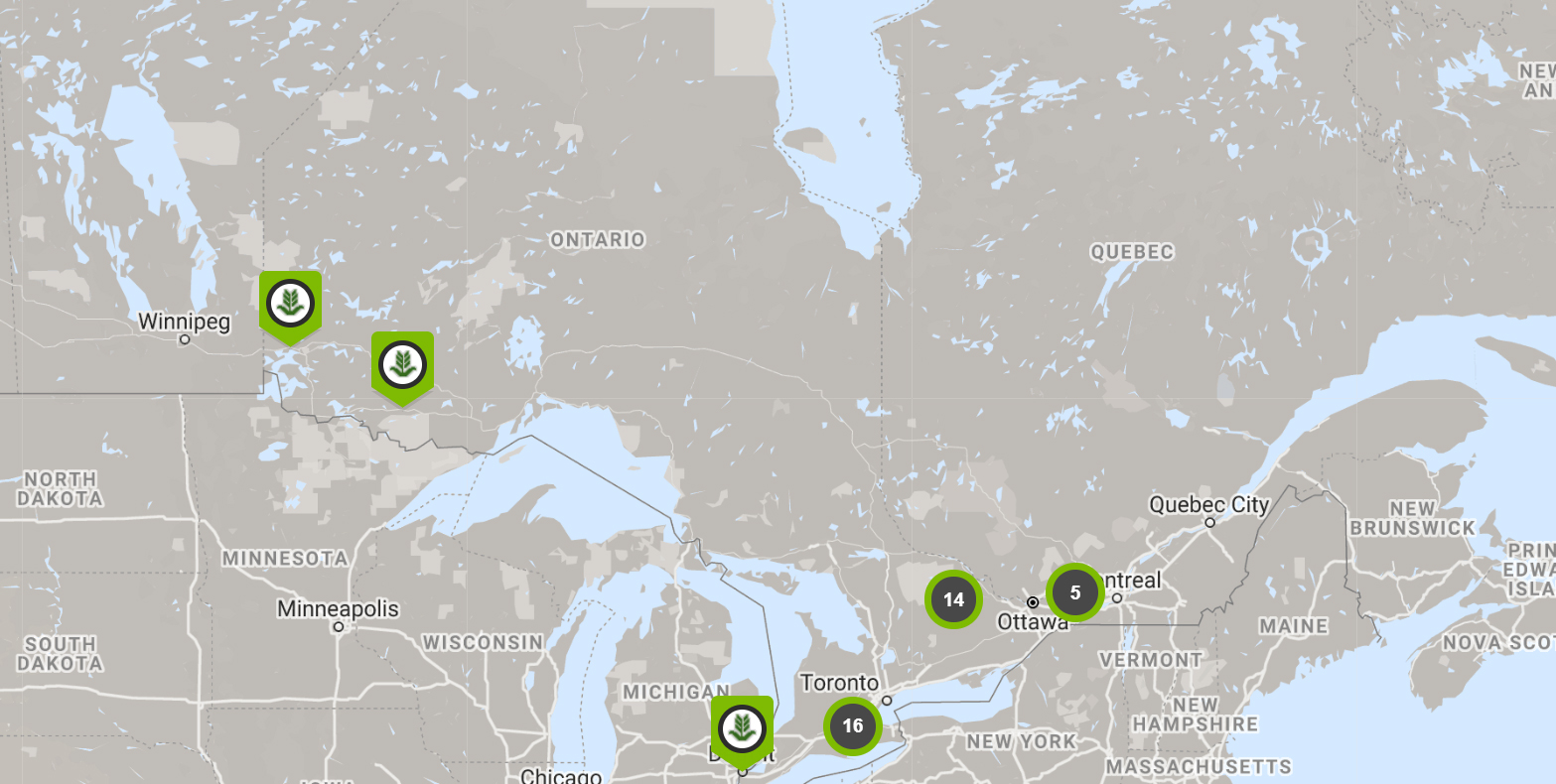

OPTrust Select Employers

OPTrust Select is designed specifically for organizations in the nonprofit, charitable and broader public sectors in Ontario and brings the advantages of OPTrust’s large scale and investment expertise to organizations that did not previously offer a defined benefit pension. The people who have joined OPTrust Select provide a range of critically important services including healthcare, community support and environmental advocacy. View the interactive map

- ARCH Disability Law Centre

- Alternative Learning Styles and Outlooks Ottawa

- Assaulted Women's Helpline

- Barry's Bay and Area Senior Citizens Home Services

- Brockville and Area Community Living Association

- Canadian AIDS Treatment Information Exchange

- Canadian Environmental Law Association

- Canadian Mothercraft Society

- Canadian Veterinary Medical Association

- Cedarhurst Dementia Care Home

- Central Toronto Youth Services

- Centre éducatif Brin de Soleil

- Clean Air Partnership

- Clinique juridique de Prescott-Russell

- Coaches Association of Ontario

- Community Food Centres Canada

- Community Legal Education Ontario

- Community Living North Bay

- Compass Early Learning and Care

- Conseil Économique and Social d’Ottawa Carleton

- Contact Brant

- Cota Health

- Crows Theatre

- Eastern Ottawa Resource Centre

- Family Councils Ontario

- Hospice Toronto

- Indigenous Diabetes Health Circle

- Job Skills Employment Services and Programs

- Kawartha Participation Projects

- Kitchener Waterloo Multicultural Centre

- Learning Disabilities Association of Windsor-Essex County

- Learning Enrichment Foundation

- MSC Canada

- Mind Forward Brain Injury Services

- Minwaashin Lodge-Indigenous Women’s Support Centre

- Muslim Association of Canada

- Newcomer Centre of Peel

- Niagara Community Legal Clinic

- Niagara Peninsula Aboriginal Area Management Board

- North York Community House

- North York Harvest Food Bank

- Nunavut Sivuniksavut

- Ontario Nonprofit Network

- Park People

- Parkdale Activity Recreation Centre

- People For Education

- Peterborough Child and Family Centres

- Peterborough Green-UP Association

- Peterborough Reintegration Services (One City Peterborough)

- PHARA Community Services

- Second Harvest Canada

- Sedna Women's Shelter and Support Services Inc. (Denise House)

- Senior Peoples' Resources in North Toronto Incorporated (Sprint Senior Care)

- Sistering, A Woman's Place

- St. Clare's Multifaith Housing Association

- Times Change Women's Employment Service

- Tri-County Community Support Services

- Victim Services Toronto

- Water First Training and Education Inc.

- Willowdale Community Legal Services

- Woman Abuse Council of Toronto

- Women’s Centre of York Region

- Women's Shelter Saakaate

What you need to know

OPTrust Select’s features:

About the Plan

OPTrust Select is a schedule of benefits under the OPSEU Pension Plan, one of the top 10 public sector pension funds in Canada.

Both schedules of benefits are administered by OPTrust. Other than budgeting for contributions, employers have no administrative costs or burdens.

OPTrust operates on a nonprofit basis, managing the fund on behalf of over 114,000 members and retirees, without taking any dividends from it. The administrative cost is about 0.35% of the fund, which compares favourably to the 2% that public market money managers might charge for a single employer plan.

The fund has over $26 billion in assets. This is large enough to access investment opportunities that single employer plans like group RRSPs typically cannot.

The Plan is fully funded, which means that we can deliver on the retirement promise made to all members: secure, predictable retirement income – for life.